Legal & Real Estate

Home, Garden & Decoration

Global Topics

Inside Ibiza

Health & Wellness

Ibiza Optimista

Related Articles

Regenerative Agriculture

READ MORE

READ MORE

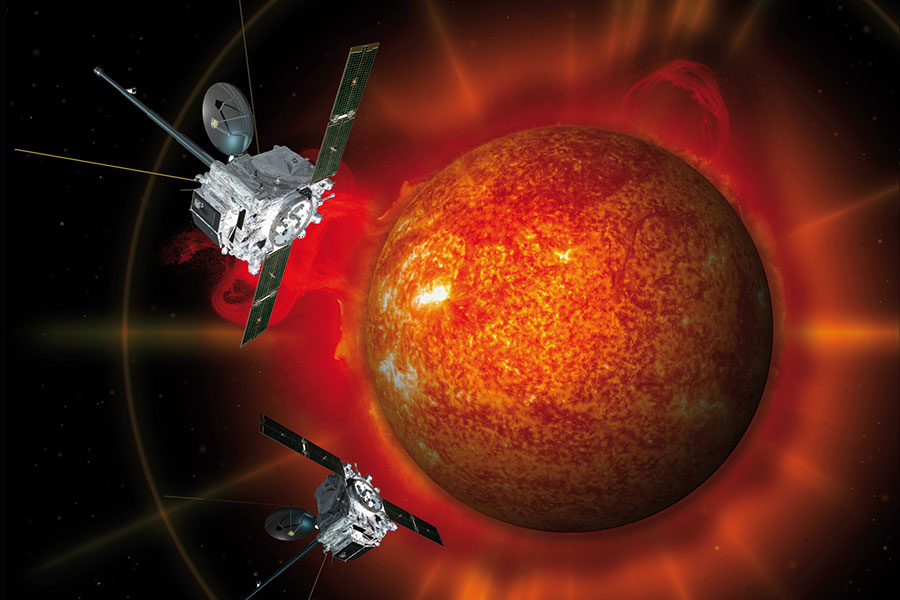

Seeing The Sun

In 2006, NASA launched the STEREO space mission to obtain a complete and three-dimensional view of the Sun. After years of work, in 2011 they achieved their goal by providi... READ MORE

In 2006, NASA launched the STEREO space mission to obtain a complete and three-dimensional view of the Sun. After years of work, in 2011 they achieved their goal by providing the first stereoscopic view of our star. Now, in 2023, STEREO-A is approaching Earth, providing a unique opportunity to st... READ MORE

Laser Weed Removal

The Carbon Robotics company in the US, has created a new machine that uses artificial intelligence (AI) to allow farmers to quickly and accurately eliminate weeds from thei... READ MORE

The Carbon Robotics company in the US, has created a new machine that uses artificial intelligence (AI) to allow farmers to quickly and accurately eliminate weeds from their fields. The “LaserWeeder” blends robotics and laser technology with AI, to eliminate over 200,000 weeds per hour without us... READ MORE

Psychedelics Therapy Growing

Australia has passed a law that allows psychiatrists to prescribe certain psychedelic substances for patients with depression or post-traumatic stress disorder (PTSD). MDMA... READ MORE

Australia has passed a law that allows psychiatrists to prescribe certain psychedelic substances for patients with depression or post-traumatic stress disorder (PTSD). MDMA (also known as ecstasy) can be prescribed for PTSD, and psilocybin, the psychoactive ingredient in psychedelic mushrooms, is... READ MORE

© Copyright 2024

Ibicasa Home and Services.